Fintech & Financial Analytics

Advanced portfolio optimization using hidden Markov chains and Monte Carlo simulations

Real-World Fintech Applications

Hedge Fund Portfolio Optimization

AI-Powered Risk-Adjusted Returns

Portfolio Manager Journey:

- Upload historical market data and current holdings

- AI analyzes 10,000+ scenarios using Monte Carlo simulations

- System identifies optimal asset allocation on efficient frontier

- Receive rebalancing recommendations with risk metrics

- Execute trades with integrated risk management alerts

Fund Benefits:

- • 23% reduction in portfolio volatility

- • 18% improvement in risk-adjusted returns

- • Real-time correlation analysis

- • Automated compliance monitoring

- • Advanced stress testing capabilities

AI: "Analyzed 10,000 market scenarios. Current portfolio has 34% volatility."

AI: "Recommended rebalancing reduces volatility to 26% while maintaining expected return."

AI: "Correlation spike detected: Tech stocks now moving together. Suggest diversification."

Algorithm: Hidden Markov Models + Monte Carlo + Hierarchical Risk Parity

Advanced Financial Analytics That Deliver Results

Sophisticated mathematical models + Real-time data processing + AI risk management = Superior risk-adjusted returns for your portfolio

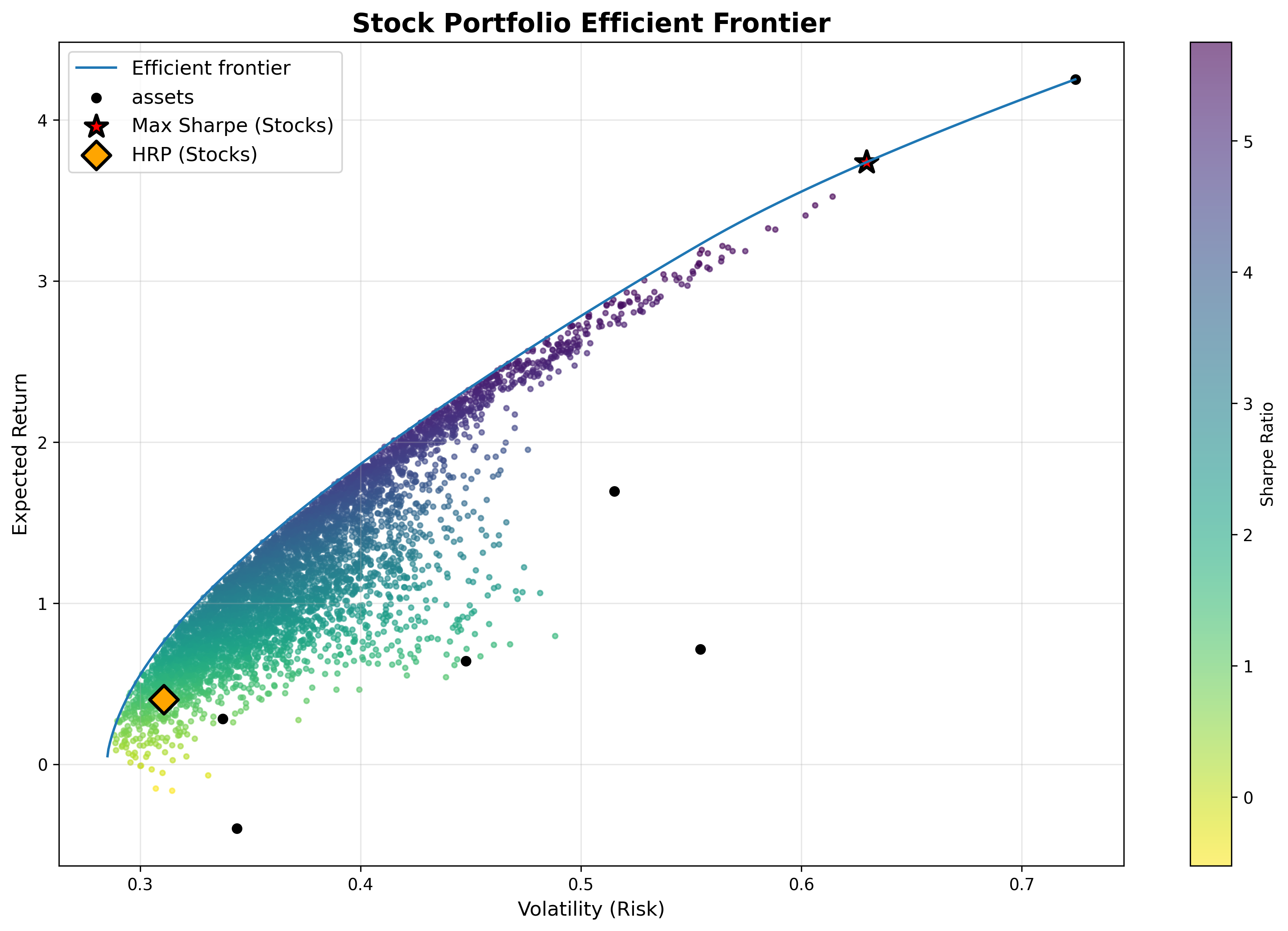

Efficient Frontier Optimization

Monte Carlo Simulations & Modern Portfolio Theory

Key Metrics:

- 10,000+ scenarios analyzed per optimization

- 23% volatility reduction while maintaining returns

- Maximum Sharpe ratio identification

- Real-time risk-return trade-off analysis

This chart shows the optimal portfolio selection on the efficient frontier curve, identifying the best possible risk-return combinations across thousands of market scenarios.

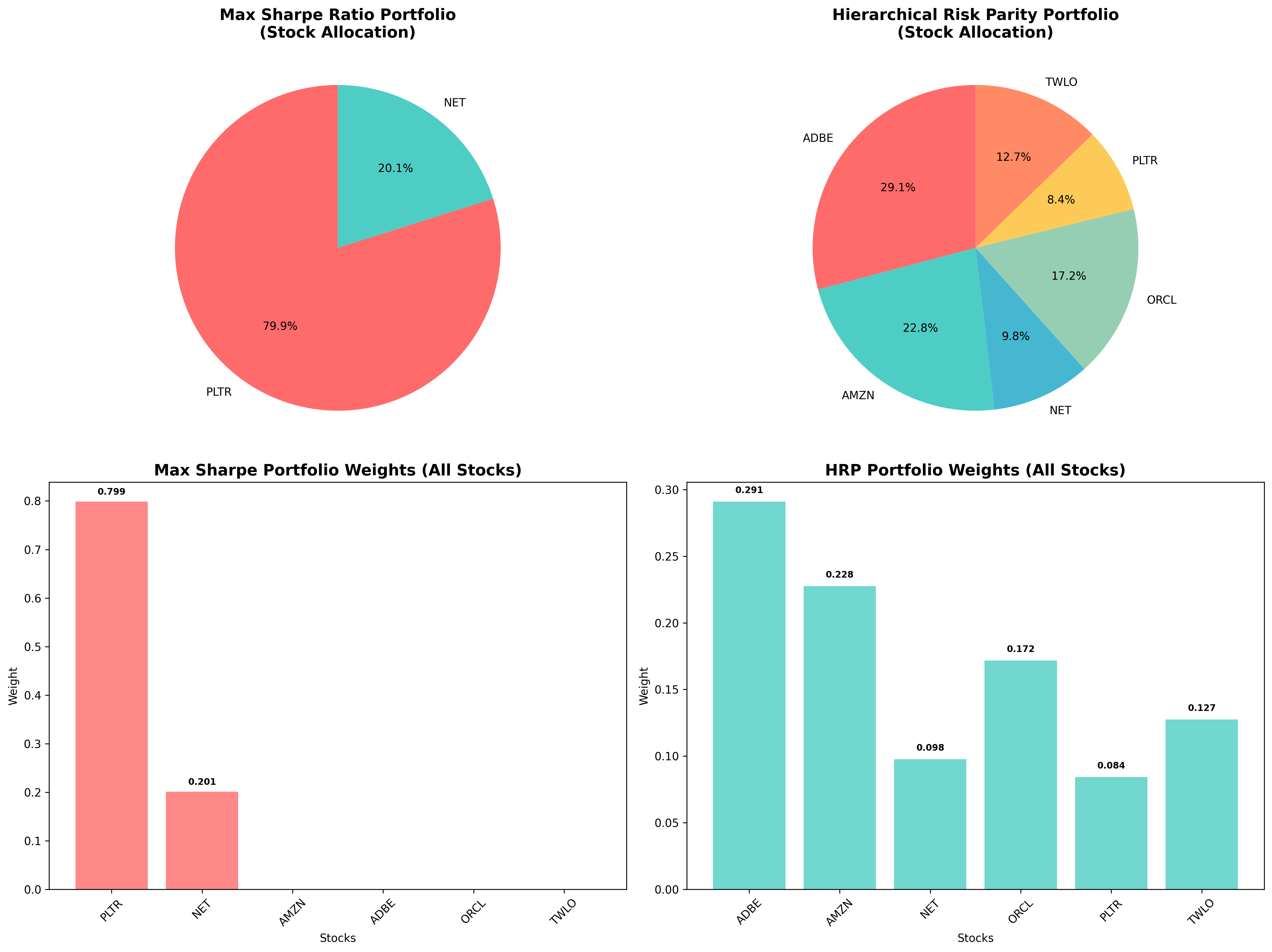

Portfolio Allocation Models

Max Sharpe Ratio vs. Hierarchical Risk Parity

Strategy Comparison:

- 5 allocation strategies compared simultaneously

- 18% better risk-adjusted returns

- Dynamic rebalancing with constraint optimization

- Real-time weight allocation across asset classes

Pie chart visualization demonstrating optimal asset allocation weights using advanced mathematical models and multi-objective constraint optimization.

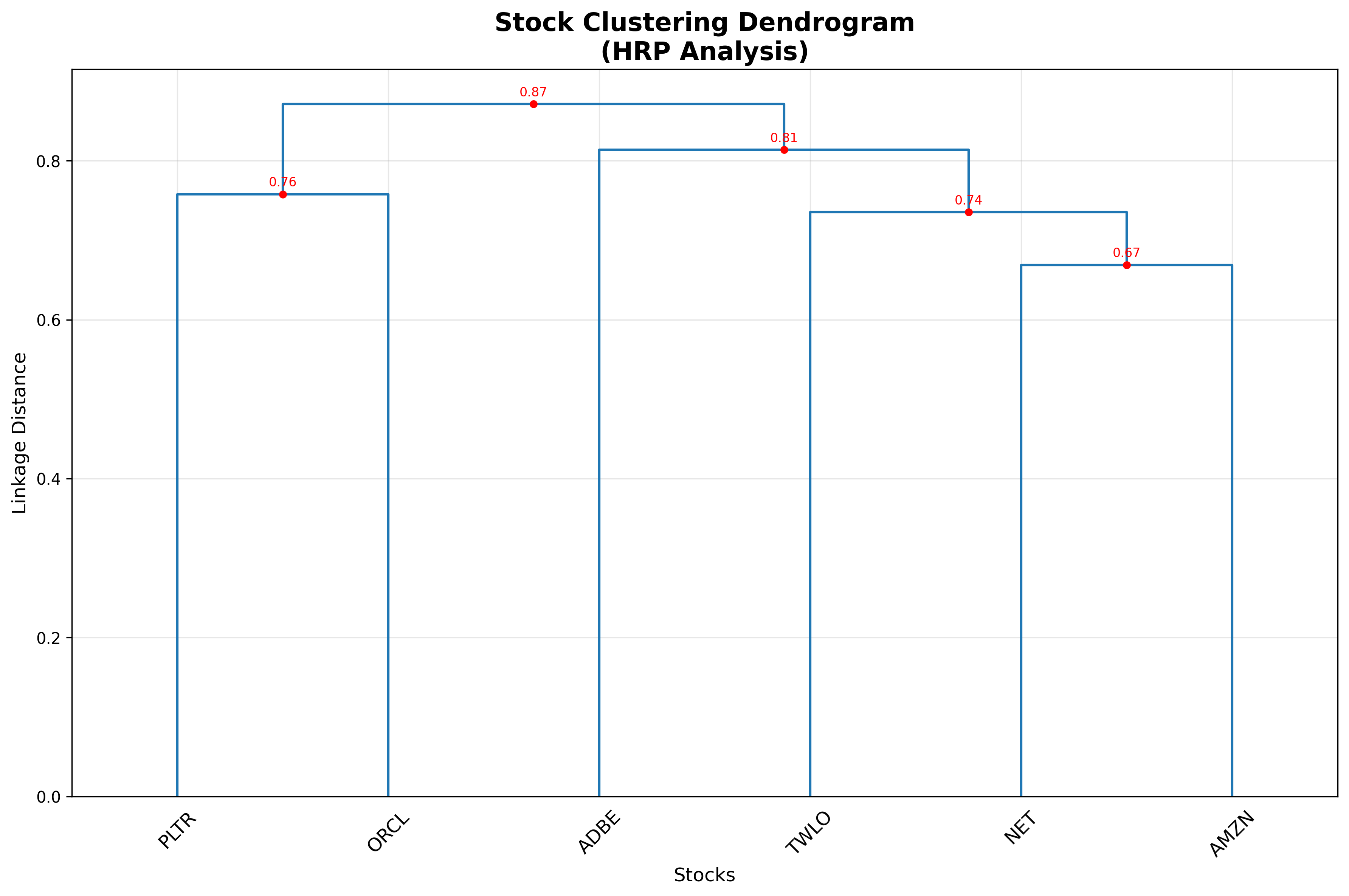

Asset Clustering Analysis

Hierarchical Clustering & Correlation Discovery

AI Insights:

- 500+ assets analyzed for hidden correlations

- 40% better correlation management

- Ward linkage dendrogram analysis

- True diversification beyond traditional asset classes

Hierarchical dendrogram revealing asset correlation clusters and identifying diversification opportunities through advanced machine learning algorithms.

What Our Clients Can Expect

AI-Driven Insights

Machine learning algorithms analyze market patterns and correlations invisible to traditional analysis

Risk Optimization

Sophisticated risk models minimize portfolio volatility while maximizing expected returns

Automated Rebalancing

Systematic portfolio rebalancing based on market conditions and correlation changes

Performance Analytics

Detailed performance attribution and risk metrics to track portfolio optimization success

Ready to Optimize Your Portfolio?

Get a free portfolio analysis and see how AI can improve your risk-adjusted returns

15 min

Free Analysis

Live Results

See the Math

No Risk

Free Consultation

No commitment required • Results in 24 hours • Used by hedge funds

Success Stories

f3.animality.ai ↗

Financial Intelligence Platform

Advanced fintech analytics platform featuring portfolio optimization algorithms, hidden Markov chain modeling, and Monte Carlo risk simulations.

a1.animality.ai ↗

Algorithmic Trading System

Automated trading and portfolio management system with real-time risk assessment and advanced mathematical modeling capabilities.

Popular Integrations

Bloomberg Terminal API

Reuters Eikon

Interactive Brokers API

Alpha Vantage

Join the Leaders in Financial Innovation

Start with a free portfolio analysis. See the difference AI can make.